It can be extremely difficult to pay for the care and treatment of a loved one, especially when one is experiencing difficulty finding work, lost their job, or are financially unstable. RiverValley Behavioral Health has some great treatment plans that we’re sure you’ll love if given the chance to experience them here at our hospital.

The best thing you can do is speak with one of our representatives who is ready to help any family members like yourself who might need financial assistance to get well again! Don’t wait for another second to recover and get on your feet again – all it takes is calling us at (270) 689-6800 or toll-free at (800) 755-8477 today!

- Complete the financial assistance application.

- Include all monthly income and expenses in the spaces provided.

- Provide proof of income, including:

- Last 2 pay stubs AND most recent filed W-2;

- Most Recent Tax Returns;

- Attestation Letter;

- Benefit awards letters or 1099 forms showing Social Security, Disability, Worker’s Compensation, or Veteran’s Administration benefits;

- Copies of benefit award letters or 1099 forms showing Unemployment, Retirement*, or Pension benefits;

- Proof of Assets which include, but not limited to checking, savings, investments, holdings, and retirement accounts for most recent three months;

- Verification of self-employment status and income received:

- Receipts from clients,

- Signed Federal income taxes form the most recent filing year which include the appropriate schedule showing income from self- employment, S-corp, or other such entity.

- Sign the financial assistance application.

If you have no income, you will need to explain how you meet your daily living expenses.

*If you have questions or need assistance completing this application, please call (270) 689-6500 or visit the Administration Office, located at 1100 Walnut St. Owensboro, KY 42301, Monday through Friday, 8:00 a.m. to 5:00 p.m.

Mail the completed application and documents to:

River Valley Behavioral

Health PO Box 1637

Owensboro, KY 42302

Attn: Financial Department

Once we have received all of the requested information and documentation, we will notify you by mail of your eligibility for participation in the Financial Assistance Program within 30 days.

Download PDF: Financial Assistance Application and Instructions

- Complete the financial assistance application.

- Include all monthly income and expenses in the spaces provided.

- Provide proof of income, including:

- Last 2 pay stubs AND most recent filed W-2;

- Most Recent Tax Returns;

- Attestation Letter;

- Benefit awards letters or 1099 forms showing Social Security, Disability, Worker’s Compensation, or Veteran’s Administration benefits;

- Copies of benefit award letters or 1099 forms showing Unemployment, Retirement*, or Pension benefits;

- Proof of Assets which include, but not limited to checking, savings, investments, holdings, and retirement accounts for most recent three months;

- Verification of self-employment status and income received:

- Receipts from clients,

- Signed Federal income taxes form the most recent filing year which include the appropriate schedule showing income from self- employment, S-corp, or other such entity.

- Sign the financial assistance application.

If you have no income, you will need to explain how you meet your daily living expenses.

*If you have questions or need assistance completing this application, please call (270) 689-6500 or visit the Administration Office, located at 1100 Walnut St. Owensboro, KY 42301, Monday through Friday, 8:00 a.m. to 5:00 p.m.

Mail the completed application and documents to:

River Valley Behavioral

Health PO Box 1637

Owensboro, KY 42302

Attn: Financial Department

Once we have received all of the requested information and documentation, we will notify you by mail of your eligibility for participation in the Financial Assistance Program within 30 days.

Download PDF: Financial Assistance Plain Language Summary

River Valley Behavioral Health Hospital (RVBHH) offers financial assistance to patients with no health insurance, or those who have out of pocket responsibilities that they cannot afford even after insurance has paid for a portion of their care. Patients must submit an application for financial assistance and all required supporting documentation, demonstrating financial need and must otherwise comply with the requirements of the Financial Assistance Policy.

The Financial Assistance Program application, policy, and Plain Language Summary may be found on River Valley Behavioral Health website. Alternatively, printed copies of the Financial Assistance Policy, the Plain Language Summary, or the application form can be obtained for free by visiting or calling the Patient Financial Service Office. You may contact the Patient Financial Services to discuss any questions you might have. If additional documents are needed, we will contact you by phone or mail to let you know what else is required.

If you are uninsured you will generally qualify for free Emergency and other Medically Necessary Care under RVBH’s Financial Assistance Program (1) if you have annual household income equal to or less than 225% of the Federal Poverty Level, (2) lack any other assets to pay for your charges and (3) if requested to do so by RVBHH, you apply for Medicaid or other state or Federal programs and fully cooperate in the application and determination process.

If you are uninsured or have a balance remaining after insurance, you will generally qualify for discounted Emergency and other Medically Necessary Care under RVBHH’s Financial Assistance Program (1) if you have household income of up to 375% of the Federal Poverty Level, (2) lack any other assets to pay for the amounts for which become personally responsible for paying and (3) if requested to do so by RVBHH, apply for Medicaid or other state or Federal programs and fully cooperate in the application and determination process.

If RVBHH determines that you are eligible for financial assistance, you will not be personally responsible for paying more than the amount we generally bill patients have insurance coverage for the same care. In addition, you will never be required to make advance payments or other payment arrangements to receive emergency services. However, you may be required in most situations to make a substantial advance deposit or agree to other payment arrangements before receiving non-emergency services.

Free copies of this summary, the Financial Assistance Policy, the Billing and Collections Policy, and the Financial Assistance Program application are available on RVBH’s website at http://www.rivervalleyandaffiliates.com/. Copies are also available at the Finance Department, located at the Cigar Factory Complex, 1100 Walnut St. Owensboro KY 42301. This information is also available by mail by contacting RVBHH Finance Department at (270) 689-6500.

RVBHH’s Patient Financial Representative staff is available to answer questions and provide information about the Financial Assistance Program and assistance with the application process. Our Patient Financial Representative staff is located in the Administrative Offices, located at the Cigar Factory Complex, 1100 Walnut St. Owensboro KY 42301. They can also be reached by phone at (270) 689-6500.

Download PDF: Financial Assistance Policy

Policy Number: FS 200.4

Implemented: December 18, 2017

- Eligibility – All individuals receiving services from RVBHH that do not have a third party payer are eligible for financial assistance.

- Basis for Charges – The gross charges for services will be reduced to the current Medicaid Accepted Rate at the date of service for any individual that does not have a third party payer.

- Discounts – Discounts will be applied using the Sliding Fee Scale as maintained in financial services policy FS 200.5. Discounts are calculated as a percentage of the gross charges for services rendered and is determined based on family income and family size.

- The following guidelines are to be used in determining family size and family income:

- A young adult living at home and dependent on parents for support should still be considered part of the family, even though they may be employed and earning income.

- Full time students, whether or not employed or drawing some income, are considered to be dependent on the family income for fee setting purposes.

- A young married couple living in the home of one of their parents would be considered a separate family and the fee set accordingly.

- An unmarried couple living together will be considered a family and treated as such for fee setting purposes.

- A young person under age 18, who is self-supporting and not living with a parent or legal guardian, will have fees determined by his/her own income.

- A person under 18 who may be receiving disability income but remains with his/her parents or a surviving parent would still be considered part of the family, and the total income would be considered for fee setting purposes.

- In the event that these guidelines do not seem to cover a case under consideration, the information should be referred to the Business Service Manager, who will make a determination as to whether the fee should be based on the total family income or the income of the individual patient.

- At the time of the initial client interview, or at times when existing clients have fee arrangements updated, business office support staff should explain our fees. Sliding fee scale arrangements for emergency services should be made as soon as possible after the fact. Clients should initially be quoted full fees, and it should be explained that these fees are baes on their ability to pay. It should be emphasized to the client that we must have their full cooperation in verifying family income and size. All sources of family income should be considered, including but not limited to gross wages, salaries, bonuses, commissions, tips, worker’s comp, Veteran’s payments, retirement/pension, unemployment compensation, self-employment income, rental income, spousal support, interest and dividends. The Business Service Manager and the CFO will determine what fees should be charged for clients who have little or no income, but who may have substantial assets, such as property, stocks, bonds, etc.

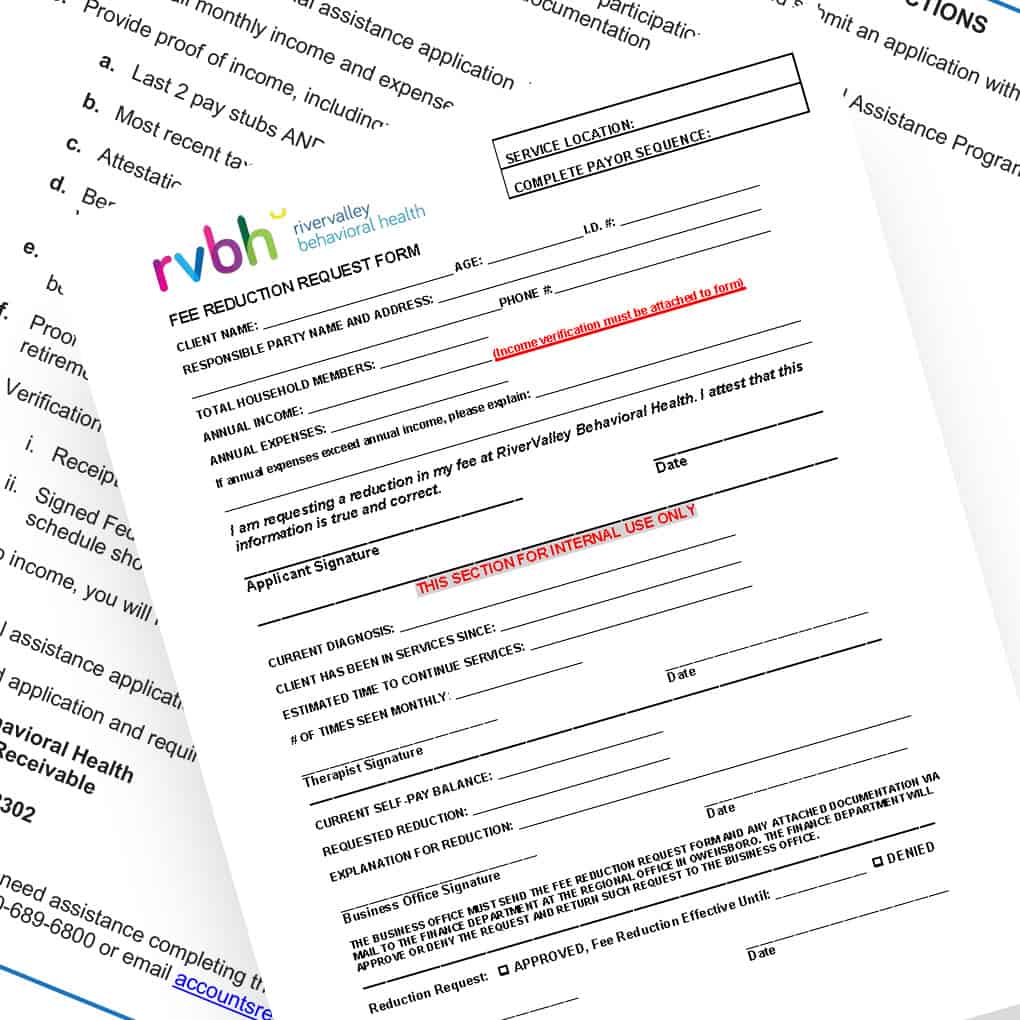

- Adjustments – Clients may apply for additional Fee Reductions by competing and submitting the “RiverValley Behavioral Health/Fee Reduction Request Form”, along with documentation of income levels. All fee reductions must be approved by the CFO. Refer to financial services policy FS 200.3 for additional information regarding Fee Reduction Requests.

- Payment Plans – RVBHH offers interest free payment plans for clients for the amounts that they are personally responsible for paying, after applying any discounts and adjustments under this policy. To participate, the client’s remaining balance must be paid at a minimum of $25 a month, have no missed payments, and must be fully paid off within 36 months.

- Collections – As described in financial services policy FS 205.0, RVBHH charges all self-pay days to the patient’s responsible party at the current Medicaid rate. Monthly statements are sent on all account balances due from the patient’s responsible party. Past due notices are put on all statements mailed that have not been paid on in thirty days. Accounts over ninety (90) days old that have not been paid on for two months are sent a final notice statement. If no payment is received after the final notice is sent, the account is sent to the CFO for final approval and the written to bad debt. Accounts approved by the CFO are turned over to our collection agency.

- Publicizing of the Policy – This Financial Assistance Policy will be widely publicized by making the current policy, along with the related Sliding Fee Scale and all related forms as described in this policy, will be available on the entity’s website. These items will also be available at the business office located at RVBHH. Each billing statement for self-pay accounts shall include information regarding the Financial Assistance Program.

- Providers – This policy applies to all providers providing services to RVBHH clients, whether they are RVBHH staff, independent contractors, or other.

Download PDF: Financial Assistance Sliding Fee Scale

Policy Title: RVBHH Sliding Fee Scale

Policy Number: FS 200.5

Implemented: December 18, 2017

RiverValley Behavioral Health Hospital (RVBHH) Services

To be used with service codes: All service codes

Select the appropriate percentage based on verified family income and size. Multiply percentage times gross charges for services rendered; round answer to the nearest dollar. This is the amount due from the client.

| Income Level | Family Size | ||||

| At Least | Not Over | 1 | 2 | 3 | 4 |

| $0 | $15,000 | C | C | C | C |

| $15,001 | $20,000 | C | C | C | C |

| $20,001 | $25,000 | D | C | C | C |

| $25,001 | $30,000 | E | D | C | C |

| $30,001 | $35,000 | F=Full | E | C | C |

| $35,001 | $40,000 | F=Full | F=Full | D | C |

| $40,001 | $45,000 | F=Full | F=Full | E | D |

| $45,001 | $50,000 | F=Full | F=Full | F=Full | E |

| $50,001 | $55,000 | F=Full | F=Full | F=Full | E |

| $55,001 | $60,000 | F=Full | F=Full | F=Full | F=Full |

| $60,001 | $65,000 | F=Full | F=Full | F=Full | F=Full |

| $65,001 | $70,000 | F=Full | F=Full | F=Full | F=Full |

| $70,001 | $75,000 | F=Full | F=Full | F=Full | F=Full |

| Full | Fee | F=Full | F=Full | F=Full | F=Full |

Select the appropriate percentage based on verified family income and size. Multiply percentage times gross charges for services rendered; round answer to the nearest dollar. This is the amount due from the client.

For each additional person add $5,000 for 10% and 20%, $10,000 for 30% and $15,000 for full fee Assign appropriate Payor Code 100 alpha code as follows:

- A = Not applicable

- B = Not applicable

- C = 10%

- D = 20%

- E = 30%

- F = 100%